Dependent Care Fsa Income Limit 2025 Over 65 - Irs rules were cited but i can't find any irs or other documentation on this high income limitation. Tabela Atualizado Irs 2023 Hsa Imagesee vrogue.co, If an individual's taxable income (after deducting rs 25,000 under section 80d) falls between rs 2.5 lakh and rs 5 lakh, the tax rate is 5%. Find out if this type of fsa is

Irs rules were cited but i can't find any irs or other documentation on this high income limitation.

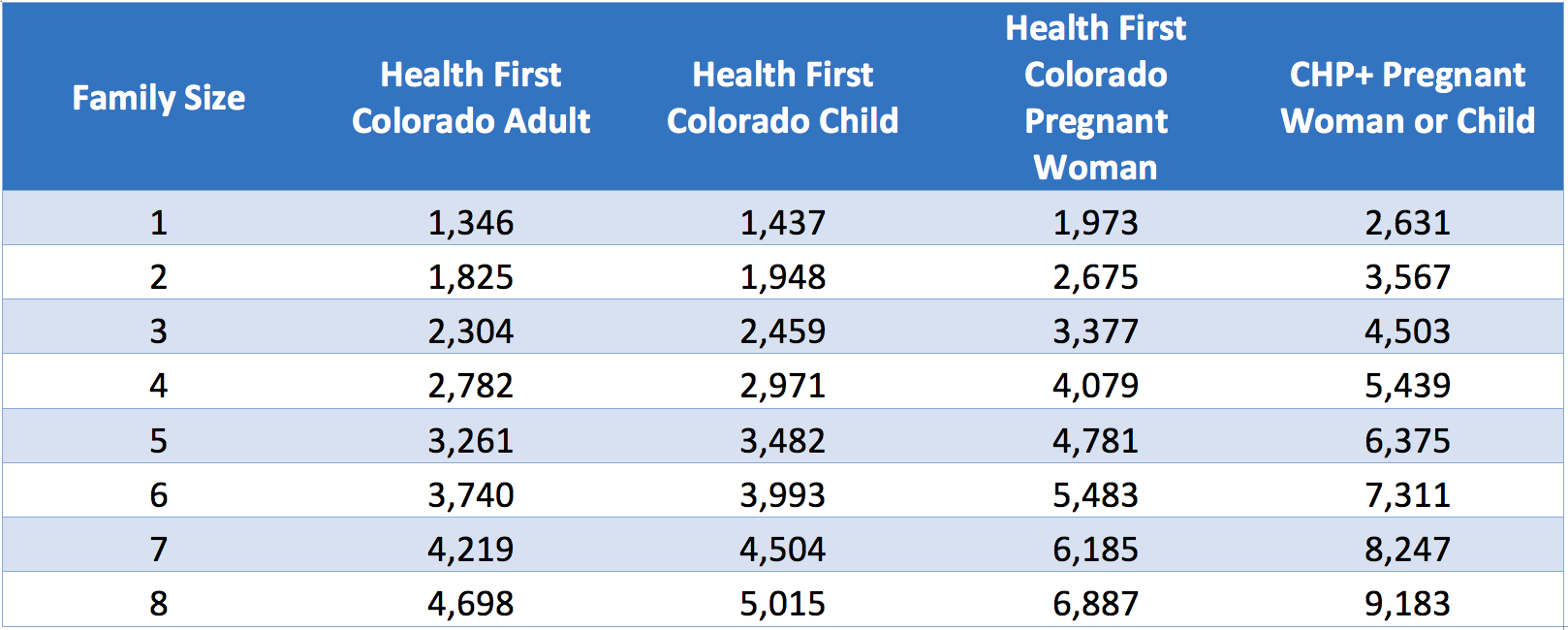

Dependent Care FSA University of Colorado, Enter your expected dependent care expenses for the year ahead. A dependent care flexible spending account can help you save on caregiving expenses, but not everyone is eligible.

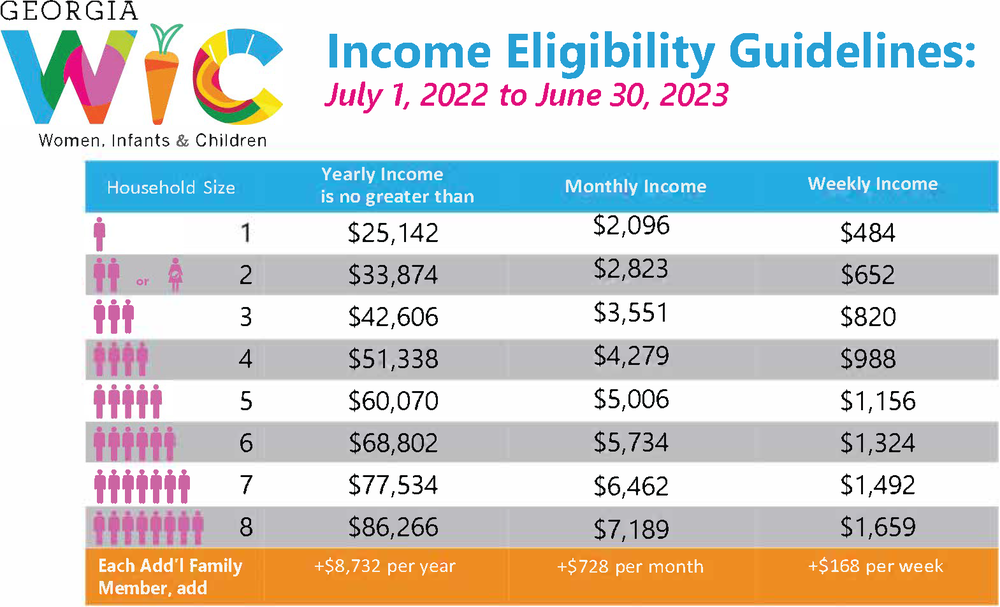

Chp+ Limits 2025 Karon Maryann, Individuals or couples with incomes below these limits are eligible to contribute to a dependent care fsa. Budget for care costs, save on taxes.

There are numerous dependent care fsa rules that specify everything from qualified expenses, what the account can cover, and eligibility.

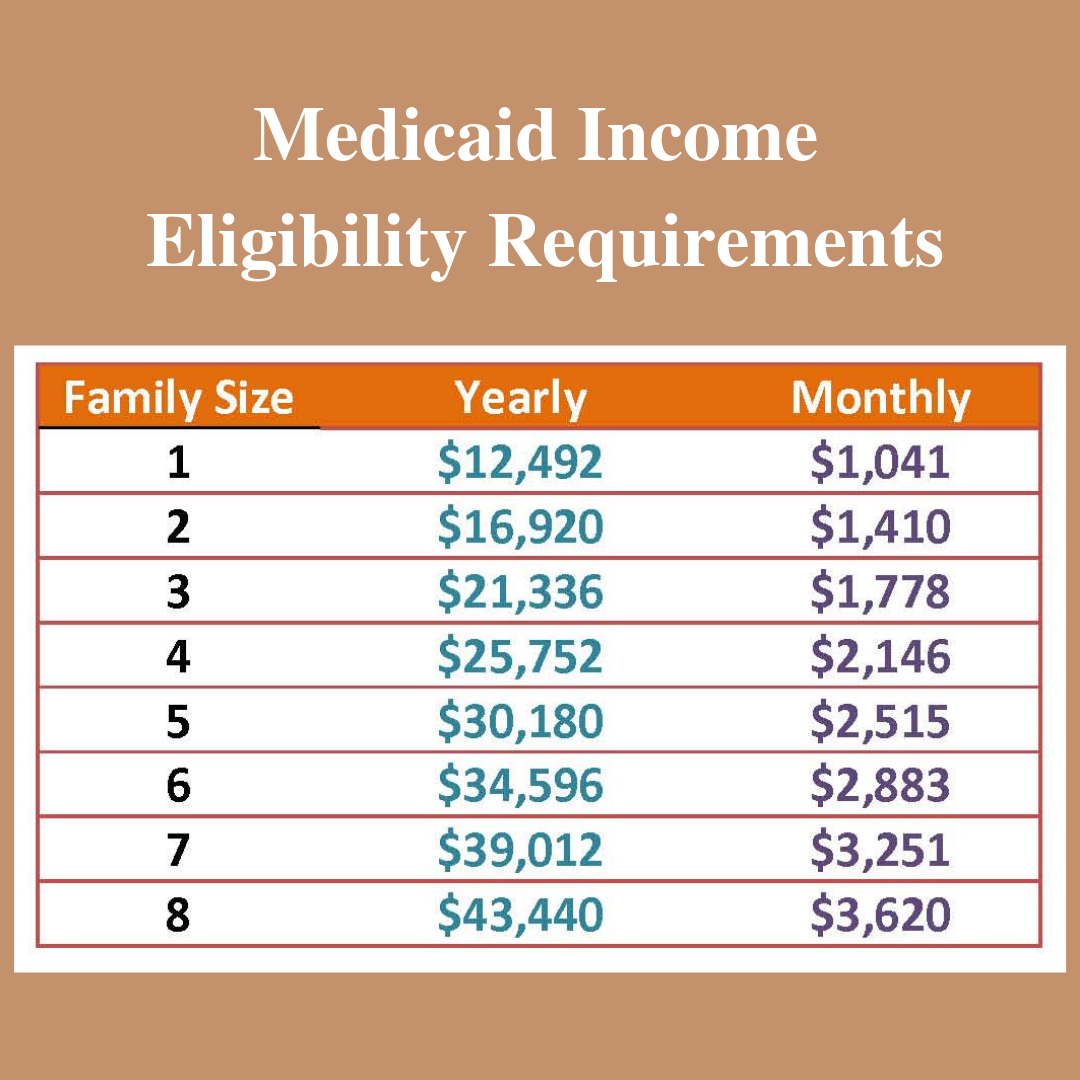

Tenncare Limits 2025 Family Of 6 Megan Sibylle, Keep in mind that any money you put into your dependent care account must be spent in the 2025 calendar year and cannot roll over to the following year. This publication explains the tests you must meet to claim the credit for child and dependent care expenses.

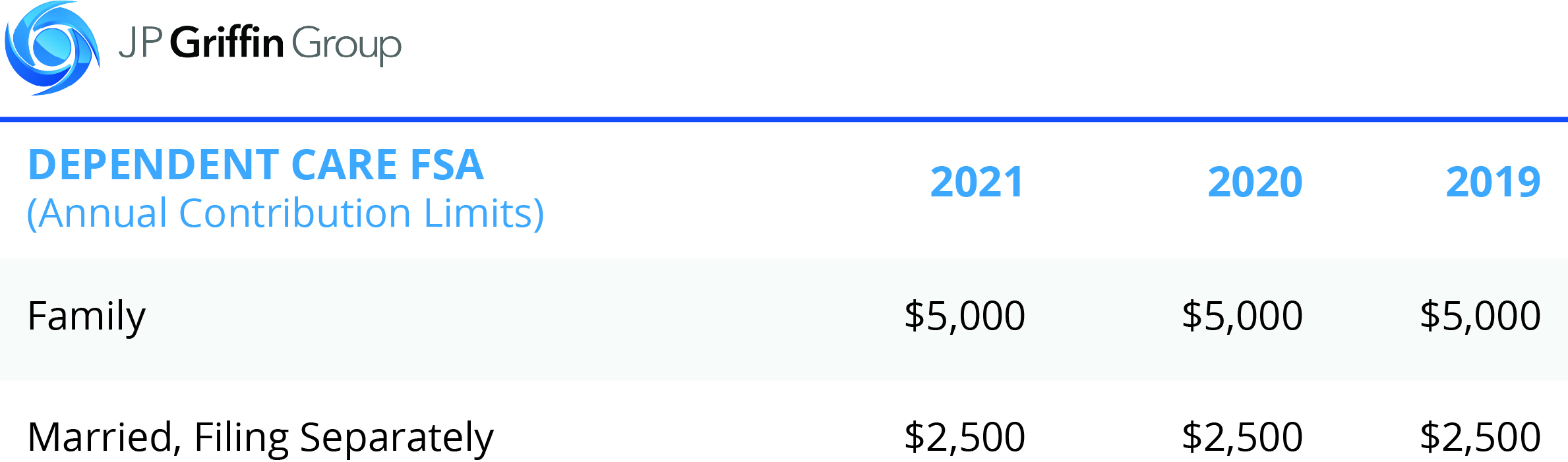

Fsa Limits 2025 Dependent Care Tera Abagail, This income limit determines who is eligible to contribute to a dependent care fsa. Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately).

Dependent Care Fsa Income Limit 2025 Over 65. My spouse is categorized as a highly compensated employee and his company says the maximum amount he can set aside for dependent care fsa (dc fsa) is $575. How does a dependent care account save money?

Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately). This publication explains the tests you must meet to claim the credit for child and dependent care expenses.

2025 Fsa Contribution Limits Irs Tiffy Tiffie, How does a dependent care account save money? The tax savings will be rs 1,300 (including cess).

Irs Dependent Care Fsa 2025 Jayme Loralie, This publication explains the tests you must meet to claim the credit for child and dependent care expenses. For 2025, as in 2023, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

Dependent Care FSA 2023 Latest Announced Contribution Limits, Due to the irs “use it or lose it” rule, you will forfeit any money remaining in your 2025 dependent care fsa after december 31, 2025, if you have not filed a claim for it by march 31, 2025. It's important for taxpayers to annually review their health care selections during health care open enrollment season and maximize their savings.